The Social Security office CANNOT give advice on when you should file.

By law, the Social Security Administration (SSA) cannot give you filing advice. They are not trained or equipped to analyze your financial situation. We are.

Depending on when you file, you could be giving up tens of thousands of dollars in potential benefit.

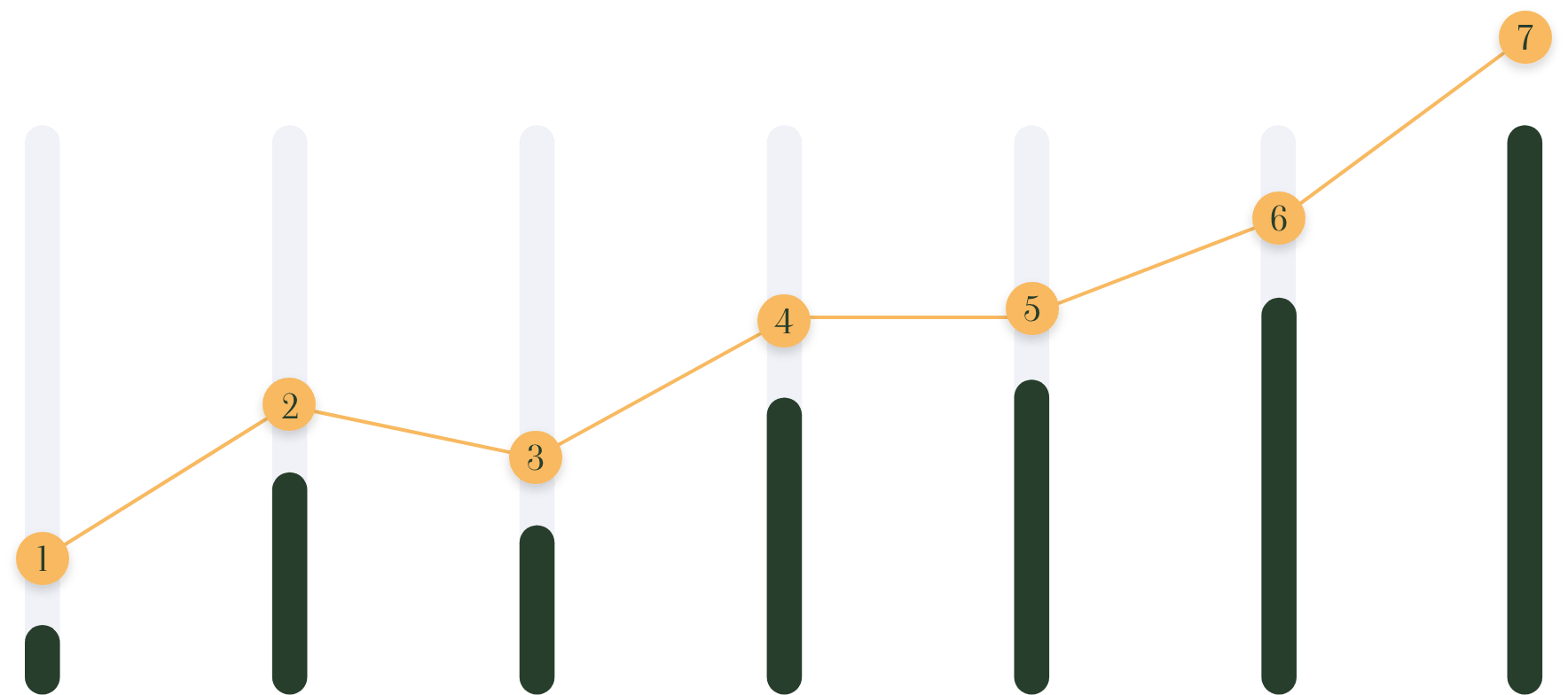

You can start filing for Social Security benefits at age 62, but your Full Retirement Age benefits are available between ages 66 to 67. Waiting until age 70 can result in even more benefits. The longer you wait to file, the more your permanent benefit will be.

You could owe taxes on up to 85% of your Social Security benefit.

Social Security taxes are calculated based on your Provisional Income, which includes a number of different earning and benefit factors. If your Provisional Income is greater than $44,000, then 85% of your Social Security benefit will be taxable.

If you file early and are still working, you could be penalized and lose some of your Social Security benefits.

Continuing to work after you’ve filed for Social Security can reduce those benefits. Ask us about the earnings test exception that may be available to you in your first year of filing.

If you’ve been married before, you may be entitled to spousal benefits.

If you have a prior marriage that lasted 10 or more years and you are currently unmarried, you could be eligible for a Spousal Benefit from your ex-spouse.

If you have a deceased spouse you may still be able to collect benefits.

If you were married for at least 9 months prior to your spouse’s death, you may be entitled to a Social Security benefit on their record.

If you were born before 1954, you could be entitled to a "hidden benefit."

Filing for a restricted benefit is available to those born prior to 1954. If you are eligible, you can file for your spousal benefit while allowing your own benefit to continue to grow.